Arlene Santiago is a Vice President at MBG. She is responsible for growing the Bank’s deposit base and helping with business development. Arlene has over 13 years of experience in the Sales and Marketing sector. She spent over 10 years at JPMorgan Chase in the Private Client Division where she managed relationships, and advised high net worth and commercial clients in the North East region and internationally. During her tenure at JPMorgan Chase she was responsible for originating various banking and asset management products, lending solutions, and investment accounts.

How IntraFi Network Demand Deposits work

How IntraFi Network Demand Deposits work

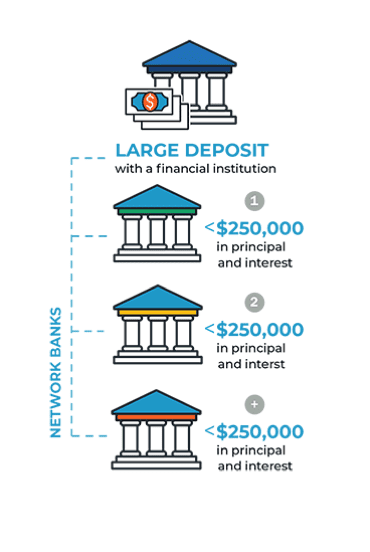

An IntraFi Network Deposit account is a secure and convenient way to manage business deposits of $250,000 or more, with full FDIC protection.

With IntraFi Network Deposits, you can:

Rest assured. Make large deposits eligible for multi-million-dollar FDIC insurance. This protection is backed by the full faith and credit of the federal government.

Access funds. Make unlimited withdrawals on any business day using the IntraFi Network Deposits demand option or up to six program withdrawals per month using the IntraFi Network Deposits savings option. Funds can be placed using either or both IntraFi Network Deposits options to match your cash management and liquidity needs.

Save time. Work directly with MBG to track account activity, balances and other information online. Set up electronic statements from a single MBG account, rather than multiple banks.